Finding the right car insurance can be overwhelming. With an abundance of choices and options, many people, especially millennials, are seeking ways to make the process easier. A growing trend among younger drivers is turning to alternative payment plans, such as flexible models that allow for lower upfront costs and more manageable options. These alternatives are appealing because they cater to the financial and lifestyle preferences of millennials, offering solutions that are both affordable and convenient. Keep reading to learn more about how these innovative payment structures are reshaping the auto insurance industry.

Digital-First Approach to Auto Insurance

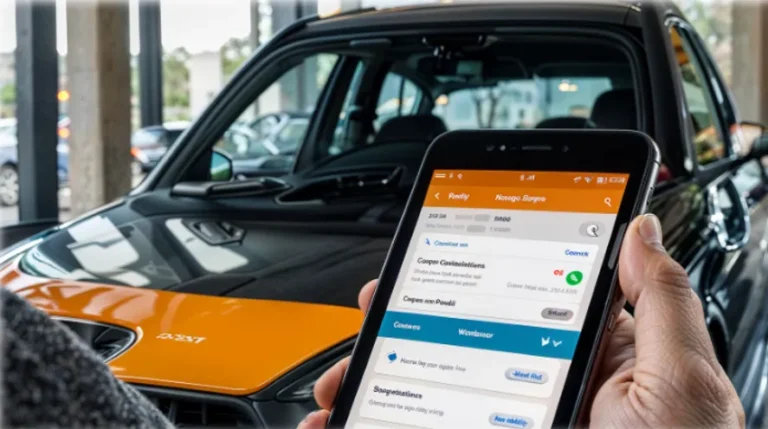

Auto insurance is evolving, and online platforms and apps are playing a major role in reshaping how people pay for coverage. Subscription-based models make managing auto insurance much easier, similar to how people pay for streaming services. This flexibility aligns with the needs of millennials and Gen Z, who are digital-first consumers.

Online platforms and apps

Online platforms and apps are key for Gen Z in managing insurance policies. They use these digital tools to compare prices, learn about coverage, and make transactions. A growing number of users turn to platforms that allow them to get direct auto insurance without needing intermediaries, offering more convenience and control.

Subscription-based insurance models

Subscription-based insurance models are changing how people pay for auto insurance. They allow customers to pay monthly, like a subscription to a streaming service. This model offers flexibility and can be changed or canceled anytime without big penalties. Millennials and Gen Z find this appealing because it matches their digital lifestyle.

Demand for Affordability and Flexibility

Millennials are seeking auto insurance plans that offer flexibility and affordability. This includes pay-as-you-go options and usage-based insurance, reflecting a shift in consumer preferences.

Pay-as-you-go plans

Pay-as-you-go plans let people pay for auto insurance based on how much they drive. This plan is great for folks who don’t use their car a lot. It helps save money and fits the budget better. For those who need car insurance now pay later, these plans can provide immediate coverage without large upfront payments.

Usage-based insurance

Usage-based insurance, also known as telematics or pay-as-you-go insurance, is gaining popularity among Gen Z and millennials. This type of auto insurance uses technology to monitor driving behavior, offering discounts for safe driving habits such as avoiding sudden stops or maintaining a steady speed.

The appeal lies in the potential cost savings and personalized premiums based on individual driving performance. However, this approach raises concerns about privacy since it involves tracking and sharing real-time data from vehicles.

For younger drivers who may be more financially cautious, usage-based insurance offers an attractive alternative to traditional fixed premiums. It aligns with their preference for flexibility and affordability while allowing them to take control of their own car insurance costs.

As more people become accustomed to sharing personal data through digital platforms, there’s a growing acceptance of telematics-based insurance models among this demographic group.

Preference for Simplicity and Transparency

Millennials seek easy-to-understand policies and straightforward terms in their auto insurance. They value real-time tracking of data to ensure transparency without complexity.

Clear policies and terms

Younger generations, particularly Gen Z, prefer simpler and more transparent insurance policies without hidden fees. Insurers focusing on these aspects, combined with providing flexible payment plans are gaining favor with this demographic.

Companies offering clear terms and transparency are likely to garner favor with younger consumers who value straightforwardness in insurance products.

Insurers catering to Millennials and Gen Z must focus on delivering comprehensive offerings that align with the demand for simplified and transparent policies. It is essential for companies in the insurance industry to keep up with these preferences of the younger market segments in order to stay relevant in a constantly changing landscape.

Real-time data tracking

Auto insurance companies are using real-time data tracking to offer usage-based pricing and rewards for safe driving. This approach appeals to Gen Z, who prioritizes affordability and transparency in their insurance plans.

However, concerns about privacy arise due to the collection of personal driving habits for these programs. Insurers must navigate this balancing act, meeting customer demands while ensuring the security of their data.

Insurers are also incorporating AI and data analytics into their services, aiming to provide personalized solutions. These advancements align with Gen Z’s expectations for seamless digital experiences but also intensify the need for robust data security measures.

As insurers continue down this path, they face the challenge of maintaining trust among younger policyholders while safeguarding sensitive information.

Environmentally and Socially Conscious Choices

Millennials are looking for insurance plans that align with their environmental and social values, seeking out green incentives and community-based models. These choices reflect a deeper concern for sustainability and the impact of their decisions on the larger community.

Green insurance incentives

Insurance companies offer rewards and discounts to customers who drive eco-friendly vehicles or take steps to reduce their carbon footprint. These perks can include reduced premiums for hybrid or electric car owners, discounts for using public transportation, or rebates for implementing energy-efficient measures at home.

A survey revealed that 47% of Gen Z consumers would consider switching to an insurer with an eco-friendly approach. Moreover, 62% of them express a willingness to pay more for insurance from a company dedicated to environmental sustainability.

The shift towards green incentives is motivated by Gen Z’s emphasis on social responsibility and sustainability, leading this generation to favor insurance companies that share these values.

As concerns about climate change continue to grow, younger generations view insurance not only as a protective measure but also as an opportunity to contribute positively to addressing environmental challenges.

Community-based insurance models

Green insurance incentives demonstrate a shift towards community-based insurance models. By integrating environmental responsibility with coverage plans, these models attract environmentally conscious millennials and Gen Z.

Peer-to-peer (P2P) insurance and crowdfunding platforms also appeal to this demographic, reflecting their preference for collective risk management. These innovative alternatives align with the cultural and behavioral shifts of younger consumers toward more collaborative and socially responsible approaches to insurance.

The use of community-based models reflects an understanding that millennials seek not only financial benefits but also ethical alignment from their insurers. Through such models, insurers have the opportunity to tap into the growing demand for more sustainable, socially aware, and participatory insurance solutions amongst younger demographics.

Integration of Technology and AI

As we delve into the integration of technology and AI in auto insurance, consider how personalized coverage through data analysis and AI-driven claims processing is revolutionizing the industry.

This tech-forward approach is reshaping auto insurance with its ability to tailor coverage based on real-time data and streamline claims processes.

Personalized coverage through data analysis

Insurers are now using AI and data analytics to create personalized solutions for Gen Z. This helps in tailoring auto insurance plans to individual needs based on driving habits, location, and other relevant data.

For example, usage-based pricing and telematics tracking of safe driving behaviors have become attractive options for younger drivers, aligning with their desire for customization and cost-effectiveness.

Moreover, the integration of technology allows insurers to offer discounts based on real-time driving behavior tracked through telematics devices. While these innovative approaches can appeal to Gen Z’s tech-savvy nature, it’s important to note that privacy concerns may arise as more personal data is collected by insurers.

AI-driven claims processing

Insurance companies are leveraging AI to expedite the processing of claims. With AI, they can swiftly assess and authenticate claims using data, thereby accelerating the approval process for customers.

AI also empowers insurance companies to more effectively identify fraudulent claims, resulting in time and cost savings. Moreover, by automating claims processing through AI, insurers can enrich customer experiences and offer customized services tailored to individual requirements.

The incorporation of AI in claims processing is in harmony with the increasing desire for seamless digital experiences from Gen Z. This approach strikes a balance between efficient service delivery and data security, meeting the expectations of younger consumers who seek convenient and transparent insurance solutions.

Impact of Cultural and Behavioral Shifts

Cultural and behavioral shifts impact insurance choices. Millennials are seeking customizable plans and financial independence, reflecting these changes.

Focus on financial independence

Millennials and Gen Z are encountering higher financial instability, which is reshaping the norms of homeownership and retirement. Limited savings among these groups heighten their exposure to unexpected expenses, prompting a focus on financial autonomy.

A survey found that 85%-92% of Millennials and Gen Z partake in financial wellness surveys related to bank accounts and auto insurance usage. This demographic’s perspective on achieving financial stability significantly impacts their approach toward auto insurance payment plans, with a growing demand for cost-effective and adaptable options that resonate with their pursuit of independence.

The move towards prioritizing financial independence is also influenced by cultural changes, such as postponing traditional milestones like marriage, homeownership, and having children.

These factors shape the distinct insurance needs of Millennials and Gen Z as they navigate a landscape marked by increased economic uncertainty.

Emphasis on customizable plans

Younger consumers are increasingly looking for personalized auto insurance plans. This demand is fueled by the desire for policies that can be customized to their specific needs and circumstances.

For instance, pay-as-you-go plans and usage-based insurance are gaining popularity among Gen Z, as they provide flexibility and affordability based on individual driving habits. Insurance companies have acknowledged this change, highlighting the significance of providing tailored solutions through AI-driven data analysis to meet the evolving expectations of younger policyholders.

These personalized plans align with the cultural and behavioral shifts towards financial independence, addressing the need for adaptable insurance products in a changing market.

Conclusion

In conclusion, Millennials are turning to alternative auto insurance payment plans for digital convenience. Online platforms and apps offer flexible subscription-based models. They seek affordability with pay-as-you-go and usage-based plans.

Transparency is key with clear policies, real-time tracking, and eco-friendly incentives. Integration of technology provides personalized coverage and AI-driven claims processing. This shift reflects a cultural emphasis on financial independence and customizable options for the younger generation.